Visa and Google Pay Transform Digital Payments in the Philippines

Visa and Google Pay Transform Digital Payments in the Philippines

A New Era of Cashless Convenience

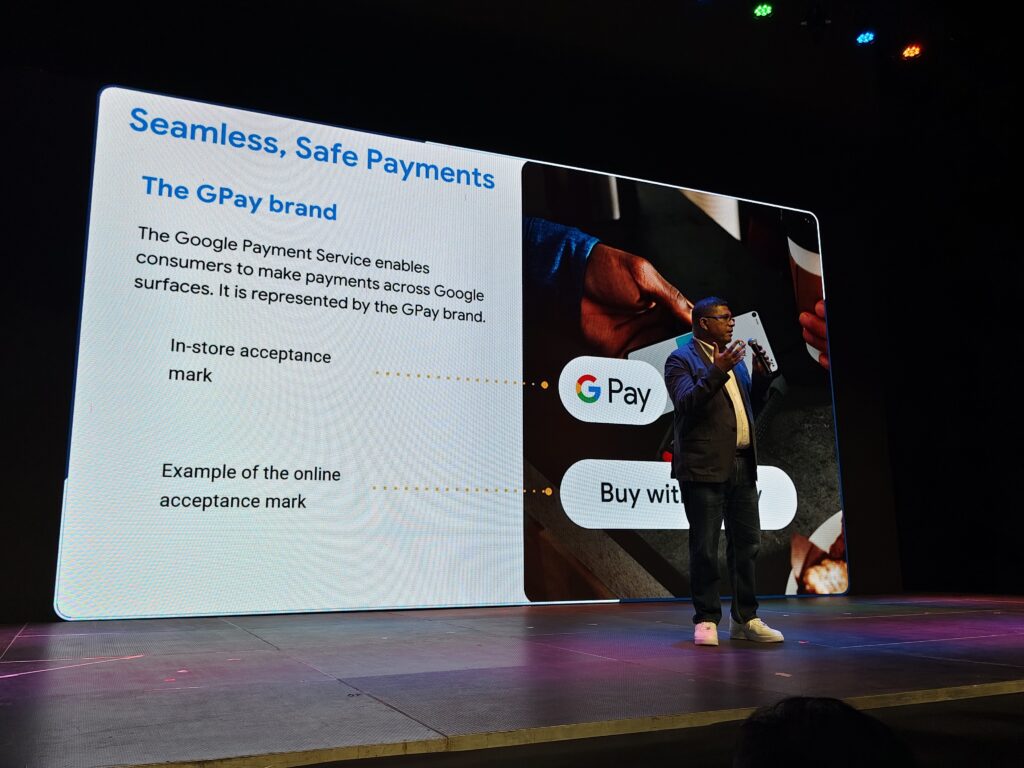

Visa, in collaboration with Google and the FinTech Alliance, has officially launched Google Wallet and Google Pay in the Philippines. This marks a significant milestone in the country’s digital payments journey. Starting November 18, 2025, Visa cardholders can now add their debit or credit cards to Google Wallet and pay using Google Pay. Visa and Google Pay Transform Digital Payments in the Philippines

The process is simple. Unlock your phone, tap at a contactless-enabled terminal, and the payment is complete. No fumbling for physical cards, no awkward handovers. Google Pay also works for online purchases and in-app transactions, making everyday payments faster and more seamless.

I’ve always believed that convenience drives adoption. Filipinos are mobile-first, and this integration makes sense. For readers, this means you can finally leave your bulky wallet at home and rely on your phone for secure, everyday transactions.

Tokenization: The Technology Behind Security

At the heart of this launch is Visa’s tokenization technology. Each time a Visa card is added to Google Pay, the actual card number is replaced with a unique digital token. This token is stored securely on the device and paired with a dynamic cryptogram for every transaction. Visa and Google Pay Transform Digital Payments in the Philippines

What does this mean? Your real account information is never shared with merchants or stored on your phone. Fraud risk is significantly reduced. Visa has already issued more than 10 billion tokens globally, with over 1.5 million e-commerce merchants transacting daily using Visa tokens. In Asia Pacific alone, Visa’s Token Service contributed to a US$2 billion uplift for merchants in 2023, while fraud rates dropped by 58%.

For readers, this means peace of mind. Every tap, every online purchase, every in-app transaction is backed by advanced security. And yes, it also means you can finally stop worrying about that shady-looking online store stealing your card details.

Partner Banks and Accessibility

Google Pay is now available in the Philippines through seven partner issuers: Chinabank, EastWest Bank, GoTyme Bank, Maya Bank, RCBC, UnionBank, and Wise. This ensures broad accessibility across different demographics, from traditional bank customers to digital-first fintech users.

The Bangko Sentral ng Pilipinas (BSP) has clarified that mobile payment providers like Google Pay are classified as technology service providers. They don’t hold consumer funds but simply link to Visa credit, debit, or prepaid cards. This regulatory stance ensures clarity and trust in how the system operates.

I’ve always said that fintech adoption in the Philippines hinges on accessibility. For readers, this means whether you’re banking with a legacy institution or a digital-first platform, Google Pay is ready to integrate into your lifestyle.

Merchant Acceptance and Promotions

Visa recognizes that merchants play a crucial role in adoption. To encourage usage, Visa has partnered with Pick Up Coffee. Across 100 participating stores nationwide, customers paying with their Visa card receive a free upsize on their drinks. Tap to pay with Google Pay, and you get an additional ₱50 off.

This isn’t just a gimmick. It’s a way to normalize digital payments in everyday transactions. Coffee shops, retail outlets, and transport systems are the perfect testing grounds for consumer behavior.

For readers, this means you can enjoy perks while experiencing the convenience of tap-to-pay. And yes, it also means your morning caffeine fix just got cheaper.

Seamless Transactions at Home and Abroad

The launch of Google Pay isn’t just about local convenience. It’s about global interoperability. Across Asia Pacific, 97% of travelers say they will bring credit, debit, or prepaid cards on their trips, while only 17% intend to bring foreign currency.

Visa’s research found that in the Philippines, 44% of tourists encounter payment problems, including merchant non-acceptance. Google Pay addresses this by offering seamless, secure payment experiences for both Filipinos traveling abroad and visitors coming to the Philippines.

For readers, this means fewer headaches when traveling. Whether you’re shopping in Singapore, dining in Thailand, or commuting in Manila, Google Pay ensures your transactions are smooth and secure. And yes, it also means you can finally stop hoarding foreign coins that end up rattling in your luggage

Driving Financial Inclusion

Visa’s Country Manager for the Philippines, Jeffrey Navarro, emphasized that Google Pay amplifies the benefits of Visa for consumers, businesses, and banking partners. By extending secure, convenient payments across shops, public transport, and tourist destinations, Visa supports the Philippines’ vision of a cash-lite economy.

This isn’t just about convenience—it’s about inclusion. Digital payments empower local merchants, reduce reliance on cash, and expand access to financial services.

I’ve always argued that financial inclusion is the real measure of fintech success. For readers, this means you’re part of a broader movement that makes payments easier, safer, and more accessible for everyone—from urban professionals to rural entrepreneurs.

My Take: Why This Matters

Visa’s introduction of Google Pay in the Philippines is a milestone. It’s not just about tapping your phone at a terminal—it’s about building an ecosystem where payments are secure, seamless, and inclusive.

What I like most is the combination of convenience and security. Tokenization ensures peace of mind, while promotions encourage adoption. The integration with partner banks makes it accessible, and the global interoperability makes it practical for travelers.

For readers, the benefit is clear: you’re getting a payment solution that simplifies your life, enhances security, and connects you to a global digital economy. And yes, it also means you can finally stop pretending you enjoy counting coins at the jeepney.

Technology That Serves Lifestyle

At its core, this launch is about technology serving lifestyle. Google Pay isn’t just a payment app—it’s a digital bridge connecting consumers, merchants, and institutions. Visa’s tokenization ensures safety, while Google’s platform ensures accessibility.

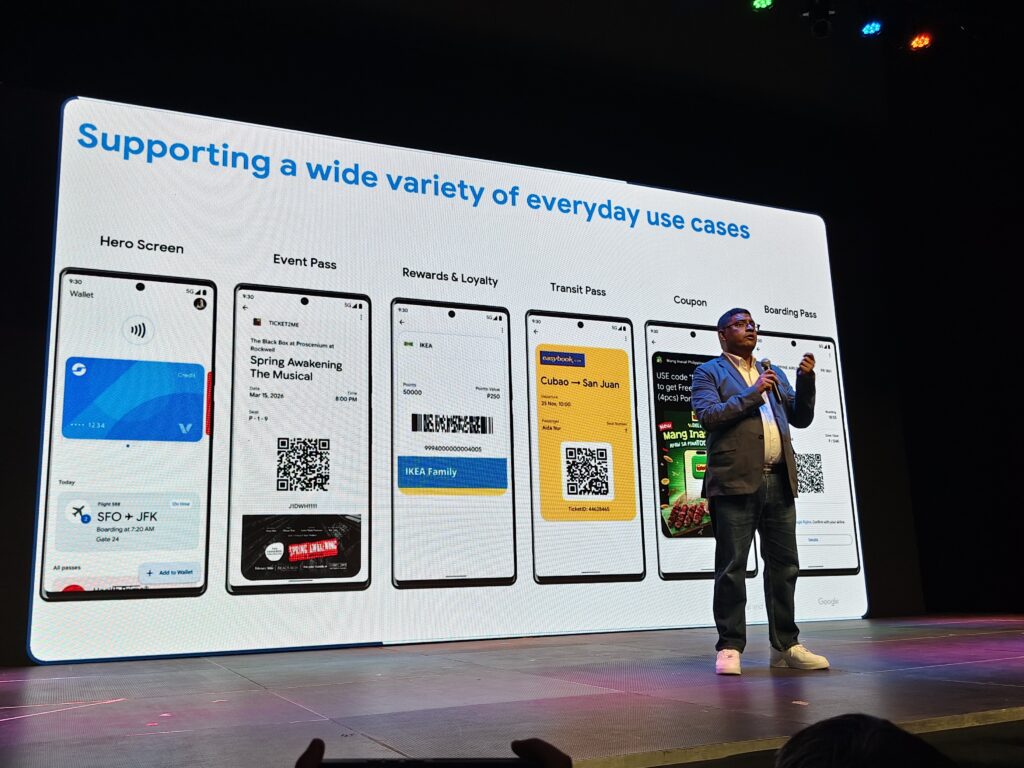

For readers, this means your phone becomes more than a communication device—it becomes your wallet, your boarding pass, your loyalty card, and your ticket to a cash-lite future.

Learn more at Visa.com.