Visa Powers Esports: Payments Meet Gaming Innovation

Visa Powers Esports: Payments Meet Gaming Innovation

Esports Meets Digital Payments

Visa has announced its role as the official payments partner of the Mobile Legends: Bang Bang (MLBB) M7 World Championship 2026 in Jakarta, Indonesia. This isn’t just a sponsorship—it’s a signal that digital payments are becoming embedded in the very fabric of esports. Visa Powers Esports: Payments Meet Gaming Innovation

The M7 World Championship is massive. Featuring 22 of the world’s top MLBB teams, including two from the Philippines, the previous edition drew over 3 million peak viewers and racked up 50 million hours of global watch time. That’s not just a tournament—it’s a cultural moment.

I’ve always said esports is more than entertainment—it’s infrastructure. For readers, this means Visa isn’t just slapping its logo on a stage—it’s wiring the future of how gamers pay, play, and participate. And yes, it also means you can stop saying, “Payments have nothing to do with gaming.”

The Philippines: A Rising Esports Hub

With 43 million Filipinos engaged in esports or mobile games, the Philippines has become a key hub in Asia-Pacific. The market size hit USD 28.6 million in 2025, and MLBB reigns supreme with 110 million monthly active users across the region. Visa Powers Esports: Payments Meet Gaming Innovation

This isn’t surprising. High mobile penetration, affordable data, and a young, tech-savvy population have created the perfect storm for esports growth.

I’ve always argued that mobile gaming is the great equalizer. For readers, this means the Philippines isn’t just consuming esports—it’s shaping it. And yes, it also means you can stop saying, “Esports is only for PC gamers.”

Passion Points and Payments

Visa’s Gen Z Decoded Report revealed that 16% of Gen Zs attended gaming or esports events in the past year, while 20% attended at least one live concert. These passion points—gaming, music, sports—are redefining how millennials and Gen Z spend, shop, and connect.

Visa’s strategy is clear: embed payments into these cultural moments. By aligning with esports, Visa amplifies the power of payments, making them part of the experience rather than just a transaction.

I’ve always said payments should feel invisible. For readers, this means Visa is turning your in-game purchase into part of the fun, not a chore. And yes, it also means you can stop saying, “Payments are boring.”

GCash Partnership: Seamless In-Game Payments

Visa has partnered with GCash, the Philippines’ leading superapp, to enhance gaming experiences through seamless, secure, and fast in-game payments.

This matters because friction kills immersion. Nobody wants to fumble through clunky payment screens while buying skins or upgrading gear. Visa and GCash are making sure the process is smooth, secure, and instant. Visa Powers Esports: Payments Meet Gaming Innovation

I’ve always argued that payments should never break the flow. For readers, this means your MLBB purchase won’t feel like a bank transaction—it’ll feel like part of the game. And yes, it also means you can stop saying, “In-game payments are a hassle.”

Esports Goes Mainstream

Esports is no longer niche. It’s now an official Olympic discipline and a staple of regional and local sporting events. Visa’s involvement reflects this mainstreaming, as the company works with global esports powerhouses to unlock exclusive access for bank partners and millions of Filipino gamers.

This isn’t just about sponsorship—it’s about legitimacy. When a global payments leader invests in esports, it signals that the industry has matured into a serious economic and cultural force.

I’ve always said legitimacy comes from unlikely places. For readers, this means esports isn’t just fun—it’s recognized, monetized, and institutionalized. And yes, it also means you can stop saying, “Esports is just playtime.”

Local and Global Fan Experiences

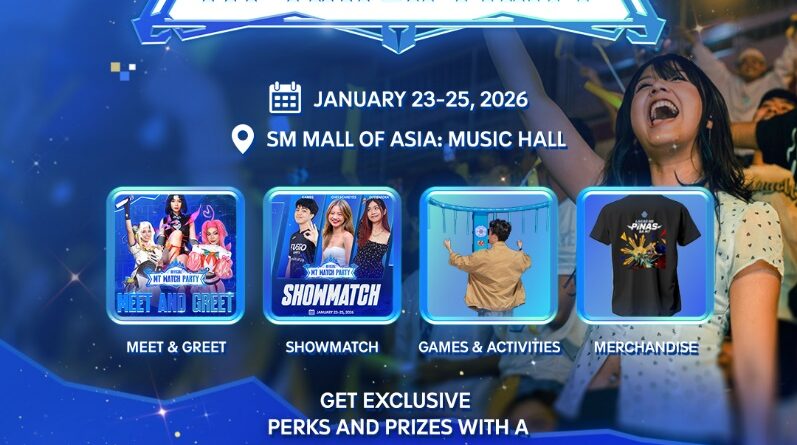

As part of the partnership, Visa and GCash are bringing select MLBB enthusiasts to experience the M7 World Championship live in Jakarta. For those staying home, a grand watch party at the Mall of Asia Arena will run from January 24–25, 2026.

This dual approach—global access and local celebration—shows how esports fandom is being nurtured. It’s not just about watching—it’s about participating in a shared cultural moment.

I’ve always argued that fandom is the fuel of esports. For readers, this means Visa isn’t just enabling payments—it’s enabling experiences. And yes, it also means you can stop saying, “Esports fans are just online.”

Technology as a Driver of Inclusion

Visa’s investment in esports isn’t just about gaming—it’s about financial inclusion. By embedding secure and convenient payments into gaming, Visa is broadening access to digital financial tools for millions of Filipinos.

This matters because many gamers are young, unbanked, or underbanked. By connecting esports with digital payments, Visa is helping them step into the broader digital economy.

I’ve always said inclusion is the real win. For readers, this means your MLBB purchase could be your first step into financial empowerment. And yes, it also means you can stop saying, “Gaming doesn’t build financial literacy.”

My Take: Payments That Play

I’ve covered countless fintech partnerships, but this one stands out because it’s practical. Visa isn’t just sponsoring esports—it’s embedding payments into the ecosystem, making them part of the experience.

What I like most is the balance. The partnership delivers security, convenience, and inclusion while amplifying cultural passion points. It’s innovation that feels natural, not forced.

For readers, the benefit is clear: Visa’s involvement in esports means smoother payments, richer experiences, and broader access to the digital economy. And yes, it also means your next MLBB skin purchase might feel less like a transaction and more like part of the game.