Singlife Philippines Redefines Legacy Through Smart Protection

Singlife Philippines Redefines Legacy Through Smart Protection

Providing a Final Act of Love

In Filipino culture, being present is essential. Whether celebrating milestones or facing hardships, showing up is how we express love and support. But what happens when you can no longer be there for the people who matter most?

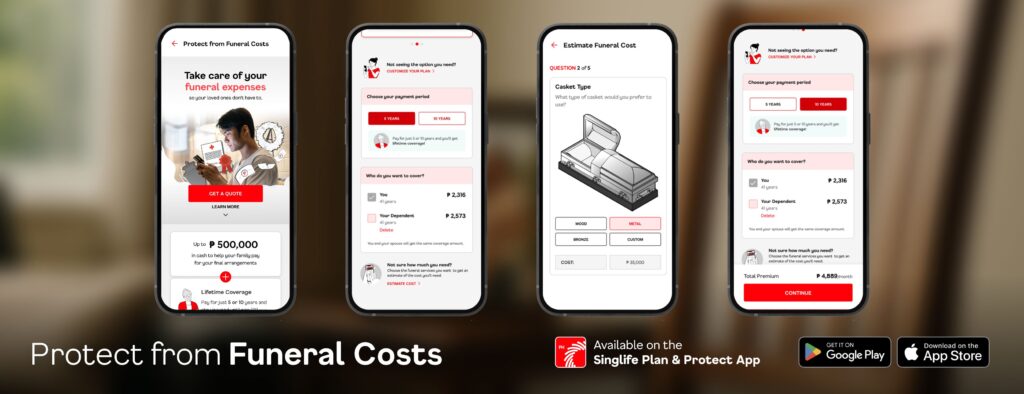

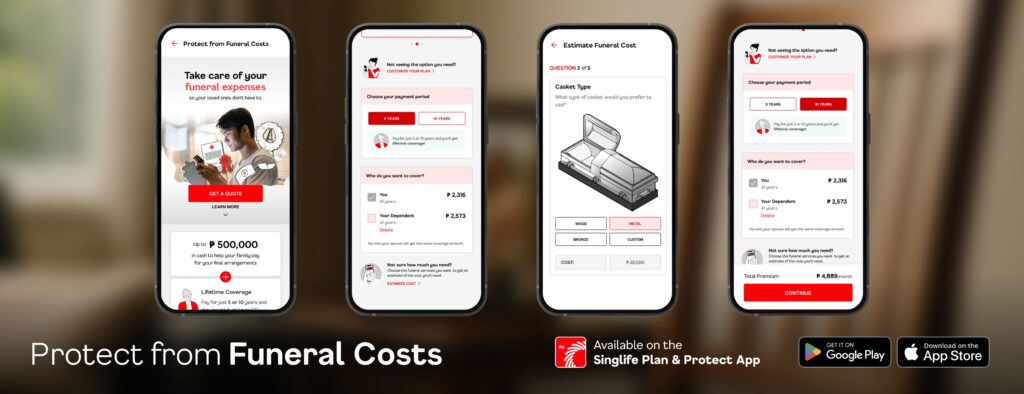

Singlife Philippines addresses this concern with its latest offering, Protect from Funeral Costs, available through the Singlife Plan & Protect App. This whole life insurance product ensures your loved ones can focus on honoring your memory without financial worries. With a lump sum benefit of up to ₱500,000, families can cover funeral arrangements and essential end-of-life expenses with ease.

Accessible entirely through Singlife’s mobile-first platform, this solution empowers Filipinos to prepare responsibly, giving peace of mind that they are taking care of those they love—even in their absence.

Eliminating Financial Burdens in Difficult Times

Funeral costs in the Philippines often exceed ₱200,000, placing an unexpected financial burden on families already grieving a loss. Many rely on abuloy or fundraising, making an emotionally challenging situation even more stressful.

Lester Cruz, Chief Executive Officer of Singlife Philippines, highlights the importance of preparing ahead. “Losing someone you love is already one of life’s most difficult moments, and having to rely on donations just to cover funeral costs makes it even harder. Protect from Funeral Costs allows you to plan ahead and leave behind a final act of love—one that ensures your family can grieve without financial worry.”

This aligns with Singlife’s commitment to empowering Filipinos toward financial independence—not just in life, but beyond it.

A Growing Suite of Digital Protection Plans

Protect from Funeral Costs is part of Singlife’s expanding lineup of digital-first insurance and investment solutions, all designed to provide convenient access to protection when it’s needed most.

Through the Singlife Plan & Protect App, customers can purchase life insurance, medical cost coverage, and investment-linked plans, with a seamless experience similar to booking a flight or managing a savings account. This mobile-driven approach makes financial security easier and more accessible for every Filipino.

Flexible Coverage That Adapts to Your Needs

Protect from Funeral Costs offers customizable and affordable protection, ensuring policyholders receive the right level of financial support for their families.

- Choose coverage from ₱100,000 to ₱500,000, with premiums starting at ₱447 per month.

- Payment terms are set at 5 or 10 years, but coverage lasts until age 120.

- Receive yearly coverage boosts at no extra cost, helping policyholders keep up with inflation and rising funeral expenses.

To make planning easier, Singlife includes a built-in Financial Needs Analysis tool that estimates the total cost of funeral arrangements based on preferred services, casket type, memorial lot size, number of viewing days, and expected guests.

Extending Protection to Loved Ones

Singlife ensures that protection doesn’t stop at the policyholder.

- Spouse and child coverage: Extend protection under the same plan. Starting from the second policy year, you can enroll your child for free—eliminating the need for a separate policy.

- Waiver of premiums due to disability: If the policyholder becomes permanently disabled before completing premium payments, contributions will be waived while coverage remains active.

- Cash value accumulation and loan access: Over time, the policy builds cash value, allowing policyholders to borrow funds starting in the fourth year for additional financial flexibility.

Immediate Assistance in Critical Moments

Singlife understands that families often require quick financial support following a loss.

Beneficiaries receive 10 percent of the cash benefit upfront upon submission of the policyholder’s death certificate and identity verification. This ensures that urgent funeral expenses can be covered immediately, while the remaining benefit amount is released upon claim approval.

Changing the Conversation Around Funeral Planning

Despite the importance of end-of-life preparation, insurance penetration in the Philippines remains below 2 percent. Many Filipinos still view funeral planning as taboo, leading to financial vulnerability during critical moments.

Singlife is challenging this perception by offering straightforward, accessible solutions that meet people where they are—on their smartphones, and in real life.

Protect from Funeral Costs transforms what was once a difficult topic into an expression of love and foresight, ensuring families remain financially secure even during their most challenging times.

How to Secure Protection Today

Protect from Funeral Costs is available exclusively on the Singlife Plan & Protect App, which can be downloaded from the App Store and Google Play.

Using the Financial Needs Analysis tool, customers can calculate the level of coverage that best fits their family’s needs. Upon signing up, policyholders receive an instant ₱300 in Singlife Credits, helping them start their journey toward financial independence.

A Lasting Legacy of Love

Singlife Philippines redefines legacy planning, ensuring that protection continues even when life doesn’t.

With this forward-thinking insurance solution, Filipinos now have a way to safeguard their families and relieve financial burdens—giving them the ability to focus on honoring the life and memory of their loved ones without unnecessary stress.

Singlife reminds us that love does not stop—even when life does.

Click here to learn more about Protect from Funeral Costs.