PalawanPay Virtual Visa Card: Cashless, Cardless, Limitless

PalawanPay Virtual Visa Card: Cashless, Cardless, Limitless Future

A Leap Toward Digital Inclusion

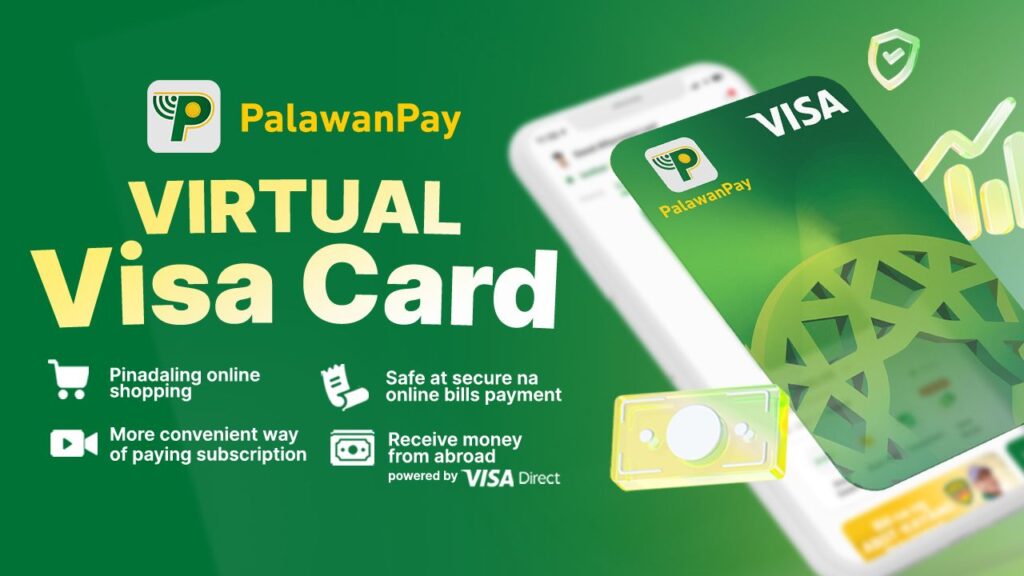

The Philippines has always had a complicated relationship with financial access. For decades, owning a Visa card felt like a privilege reserved for those with bank accounts or credit lines. That left millions of Filipinos outside the digital economy, relying on cash transactions and limited payment options. Enter the PalawanPay Virtual Visa Card—a product designed to break down those barriers and make secure, widely accepted digital payments accessible to every Filipino. PalawanPay Virtual Visa Card: Cashless, Cardless, Limitless Future

PalawanPay, the fast-growing e-wallet under the Palawan Group of Companies, has positioned this launch as more than just another feature. It’s a statement. A commitment to financial inclusion. And, if I may add, a clever way of making “pang-masa” technology feel premium without the intimidation.

I’ve always said fintech succeeds when it feels human. For readers, this means PalawanPay is giving you a tool that doesn’t just transact—it empowers. And yes, it also means you can finally stop saying, “Visa cards are only for the elite.”

Cashless, Cardless, Limitless — Designed for the Digital Filipino

With just a few taps inside the PalawanPay app, verified users can instantly activate their Virtual Visa Card. No long forms. No rigid requirements. No hassle. True to Palawan Group’s walang kuskos-balungos promise, the process is simple and practical.

Once activated, the card can be used for:

- E-commerce shopping on platforms like Shopee and Lazada

- Recurring bills and subscription services

- Travel bookings and digital wallets

- Secure money transfers powered by Visa Direct

This isn’t just convenience—it’s empowerment. For the first time, millions of Filipinos who have never owned a physical card can participate in global commerce with confidence.

I’ve always argued that simplicity is the ultimate sophistication in fintech. For readers, this means PalawanPay is giving you a Visa card that doesn’t require a banker’s handshake. And yes, it also means you can finally stop saying, “Digital payments are too complicated.” PalawanPay Virtual Visa Card: Cashless, Cardless, Limitless Future

Financial Inclusion, Levelled Up

The PalawanPay Virtual Visa Card is more than a payment tool—it’s a bridge. It empowers the unbanked and underbanked to participate confidently in the digital economy.

Because PalawanPay is deeply rooted in everyday Filipino needs, the card integrates seamlessly with existing behaviors. Users can:

- Receive remittances from abroad directly in the app

- Cash in for free at any of Palawan Express’ 3,500+ branches nationwide

- Access funds without extra cost or hidden fees

This alignment with real spending habits is critical. It ensures that the card isn’t just a shiny feature—it’s a practical solution.

I’ve always said financial inclusion isn’t about apps—it’s about access. For readers, this means PalawanPay is giving you nationwide reach without intimidation. And yes, it also means you can finally stop saying, “Digital wallets are only for city folks.”

Security and Trust: Powered by Visa

Behind the simplicity lies serious technology. The PalawanPay Virtual Visa Card is powered by Visa Direct, ensuring secure money transfers and global acceptance.

Security features include:

- Encrypted transactions

- Fraud monitoring systems

- Compatibility with international payment standards

This isn’t just about making payments—it’s about making them safe. For Filipinos wary of online fraud, the Visa backbone provides reassurance.

I’ve always argued that trust is the currency of fintech. For readers, this means PalawanPay is giving you peace of mind with every transaction. And yes, it also means you can finally stop saying, “Online payments aren’t safe.”

Everyday Use Cases: Practical and Accessible

The beauty of the Virtual Visa Card lies in its versatility. Imagine paying for Netflix without borrowing someone else’s card. Booking flights without visiting a travel agency. Shopping online without cash-on-delivery headaches.

For small businesses, the card opens doors to digital marketplaces. For families, it simplifies remittances and subscriptions. For individuals, it’s a ticket to global commerce.

I’ve always said technology should solve everyday annoyances. For readers, this means PalawanPay is giving you a card that makes life smoother. And yes, it also means you can finally stop saying, “Digital tools don’t fit my lifestyle.”

Coming Soon: Physical PalawanPay Visa Card

By 2026, PalawanPay plans to launch a physical Visa card. This will extend flexibility to point-of-sale and in-store payments worldwide.

The physical card will complement the virtual one, ensuring users can transact both online and offline. It’s a natural evolution—bridging digital convenience with traditional familiarity.

I’ve always argued that hybrid solutions win in transitional markets. For readers, this means PalawanPay is preparing you for a future where cash, cards, and apps coexist seamlessly. And yes, it also means you can finally stop saying, “I still need a physical card.”

My Take: Why This Matters

I’ve covered countless fintech launches, but the PalawanPay Virtual Visa Card stands out because it blends simplicity, security, and inclusion. It’s not trying to reinvent the wheel—it’s trying to make sure everyone can ride it.

What I like most is the balance. Instant activation for convenience. Visa Direct for security. Free cash-in for accessibility. And a roadmap toward physical cards for flexibility. Together, these elements create a product that feels practical, human, and scalable.

For readers, the benefit is clear: PalawanPay isn’t just giving you a card—it’s giving you access to a digital economy that once felt out of reach. And yes, it also means your next online purchase might just be smoother than your last trip to the mall.

Technology That Serves the Suki

At its core, the PalawanPay Virtual Visa Card is about technology serving the suki—the everyday Filipino. It’s about removing intimidation, simplifying processes, and aligning with real-world behaviors.

For readers, this means you’re not just getting a card—you’re getting a tool that respects your time, your money, and your lifestyle. And yes, it also means your next remittance, subscription, or online purchase might feel less like a hassle and more like a celebration of access.