Pru Life UK Champions Insurance-Retirement Integration

Pru Life UK Champions Insurance-Retirement Integration at Summit

Rethinking Retirement in the Digital Age

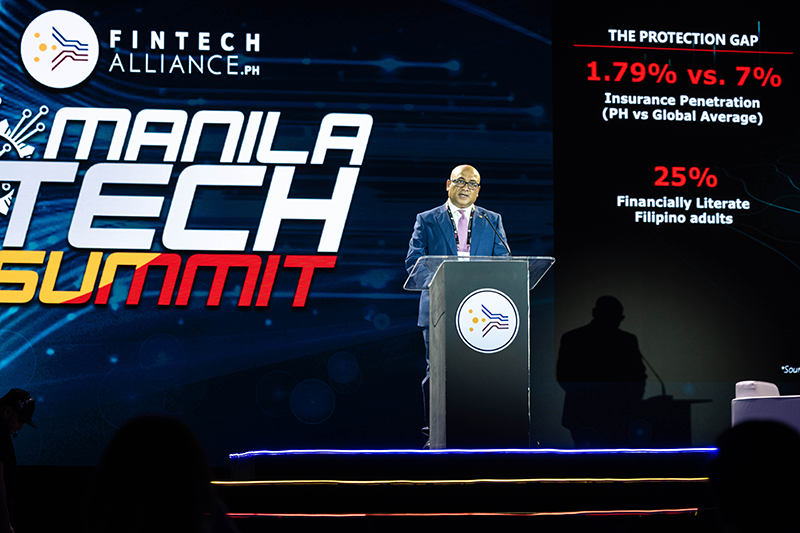

At the Manila Tech Summit 2025, Pru Life UK President and CEO Sanjay Chakrabarty delivered a message that cut through the noise: savings alone will not be enough to protect Filipinos in their later years. It’s a sobering reminder in a country where retirement planning often begins too late and ends too soon. Pru Life UK Champions Insurance-Retirement Integration at Summit

Chakrabarty welcomed the Personal Equity and Retirement Account (PERA) as a bold initiative to help Filipinos save and invest. But he also warned that without insurance, financial protection is fragile. Life has a way of throwing curveballs—illness, disability, unexpected expenses—and savings can vanish faster than a 13th-month bonus in December.

I’ve seen this play out in countless stories. Families who thought they were prepared suddenly find themselves scrambling because they underestimated the cost of long-term care or medical emergencies. That’s why the integration of insurance into retirement planning isn’t just smart—it’s necessary.

at the Manila Tech Summit.

The Weakening of Traditional Safety Nets

Chakrabarty pointed out a cultural shift that many of us have quietly noticed. Filipino families are moving from extended households to nuclear ones. The old model—where grandparents, parents, and children lived under one roof, sharing resources and responsibilities—is fading.

This means the traditional safety net of family support is weakening. When illness strikes or retirement income runs short, there are fewer relatives to lean on. That’s not pessimism; it’s reality.

The solution, according to Chakrabarty, is to build institutional, scalable, and sustainable forms of protection. In other words, systems that don’t depend on whether your cousin abroad can send remittances this month.

For readers, this shift means we can’t rely on cultural traditions alone. We need financial tools that are designed for modern realities.

Insurance as a Bridge to PERA

Here’s where things get interesting. Chakrabarty sees PERA as a bridge—a platform where insurance can be embedded into the retirement journey.

Think about it: PERA already encourages Filipinos to save and invest for the long term. But what if those accounts also included built-in insurance features? Suddenly, retirement planning isn’t just about accumulating wealth—it’s about protecting it.

This integration could cover not just mortality risks but also morbidity risks like long-term illness, disability, and the need for care. These are the silent threats that drain savings and destabilize families.

I’ve always believed that financial products should be simple, affordable, and accessible. Too often, they’re wrapped in jargon and hidden fees. If the industry can design insurance-retirement hybrids that are easy to understand and easy to use, we might finally see mass adoption.

Open Finance and Digitalisation: Expanding Access

The panel discussion, moderated by FinTech Alliance.PH Trustee Ida Tiongson, brought in voices from across the financial ecosystem. ATRAM Trust Corporation’s Deanno Basas echoed Chakrabarty’s views, highlighting how digitalisation and open finance are making retirement planning more accessible.

With over 80 percent of Filipinos now online, the opportunity is massive. Imagine logging into a single platform where you can track your PERA contributions, monitor your insurance coverage, and even simulate retirement scenarios. That’s not science fiction—it’s the logical next step.

Technology can also democratize access. Rural communities, often excluded from traditional financial services, can now participate through mobile apps and digital wallets. For readers, this means retirement planning doesn’t have to be a privilege of the urban elite. It can—and should—be for everyone.

The Role of Policy and Regulation

The Manila Tech Summit wasn’t just a gathering of industry leaders. Policymakers and regulators were also in the room, including representatives from the Bangko Sentral ng Pilipinas and the Insurance Commission.

Their presence matters. For insurance-retirement integration to succeed, we need policies that encourage innovation while protecting consumers. Open finance frameworks, data privacy regulations, and digital identity systems all play a role in making this ecosystem trustworthy and secure.

I’ve covered enough fintech launches to know that technology without regulation is chaos, and regulation without technology is stagnation. The sweet spot is collaboration, and that’s exactly what this summit was trying to foster.

Insurance as a Shield

Chakrabarty closed with a powerful line: “Insurance is more than a financial product—it is a shield.”

That metaphor resonates. A shield doesn’t stop the battle from happening, but it gives you a fighting chance. In the same way, insurance doesn’t prevent illness or aging, but it cushions the financial blow.

For readers, this means reframing how we think about insurance. It’s not just an expense. It’s protection for your future self, your family, and your peace of mind.

My Take: Why This Matters

I’ve always been fascinated by the intersection of technology and finance. Too often, though, the conversation gets stuck on buzzwords—blockchain, AI, digital wallets—without addressing the human side.

What struck me about this summit was how grounded the conversation was. It wasn’t about chasing the next big thing. It was about solving a very real problem: how to ensure Filipinos can retire with dignity and security.

For readers, the benefit is clear. Insurance-retirement integration means you don’t have to choose between saving for the future and protecting yourself today. You can do both, in one streamlined system.

And let’s be honest—if technology can make it easier to order milk tea at midnight, it should also make it easier to plan for retirement.

The Road Ahead

The challenge now is execution. Designing products that are simple, affordable, and accessible is easier said than done. But with the right mix of technology, regulation, and industry collaboration, it’s possible.

The Manila Tech Summit was a reminder that the future of finance isn’t just about apps and algorithms. It’s about people—students, workers, parents, retirees—who need tools that work for them, not against them.

If the insurance industry can rise to this challenge, we might finally see a future where retirement isn’t something to fear, but something to look forward to.

Learn more about the Philippines’ leading life insurer at www.prulifeuk.com.ph