Maya Black Card Puts Security Directly in Users’ Hands

Maya Black Card Puts Security Directly in Users’ Hands

A Numberless Card for a Numberless World

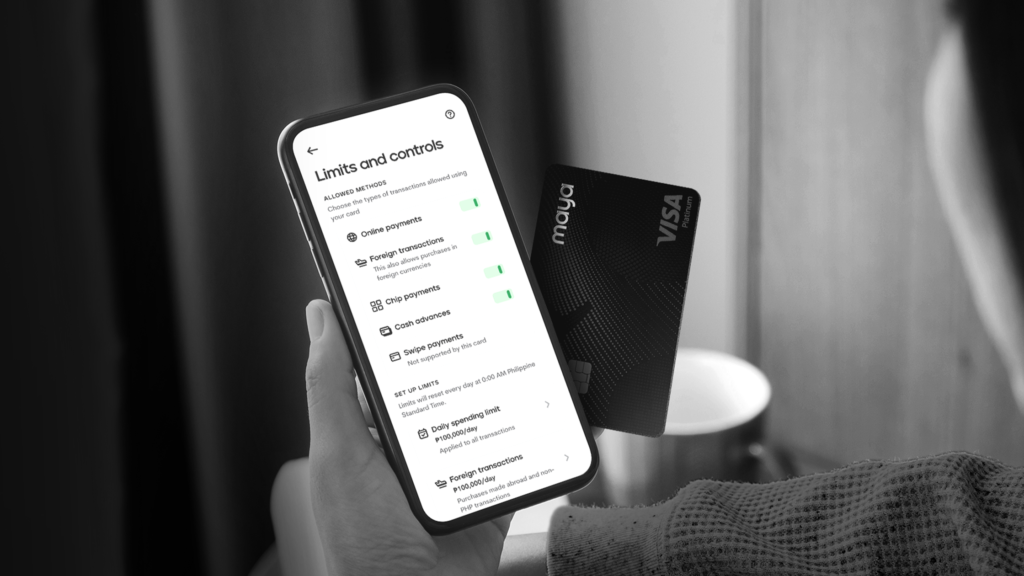

The Maya Black credit card is not your typical piece of plastic. In fact, it’s not even about the plastic anymore. This card is numberless—no printed digits, no CVV code on the back, nothing for prying eyes to copy. Instead, the CVV refreshes with every use inside the Maya app. That’s right, every transaction generates a new code. Maya Black Card Puts Security Directly in Users’ Hands.

For readers, this means one of the most common points of vulnerability—static card details—is eliminated. If someone snaps a photo of your card or tries to memorize your numbers, they’re out of luck. The details are dynamic, and only you can access them.

I’ve seen countless cases where fraudsters exploit the simplest loopholes. Maya’s approach closes one of the biggest. It’s a small change with massive implications.

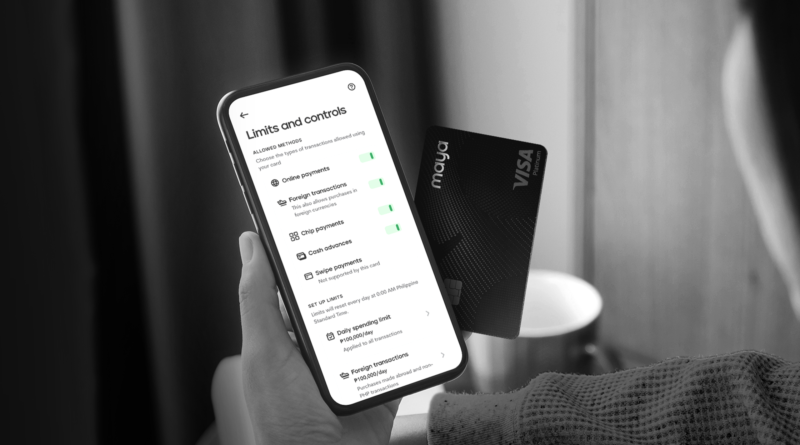

Security Center: Control at Your Fingertips

Here’s where Maya really flips the script. Instead of calling a hotline, waiting on hold, and hoping someone on the other end takes action, you get a built-in Security Center inside the app.

Freeze your card instantly. Set spending limits. Block transactions. All with a tap.

This is the kind of user-facing control that makes sense in 2025. We live in a world where everything is on-demand—rides, food, even streaming. Why should security be stuck in the 1990s?

For readers, this means you’re no longer at the mercy of call centers. You’re in charge. And that’s empowering.

Biometric Logins and AI Fraud Monitoring

Of course, a shiny app feature isn’t enough. Maya backs it up with enterprise-grade defenses. Biometric logins ensure only you can access your account. One-time passwords add another layer of verification. And AI-driven fraud monitoring works in the background, blocking suspicious activity before it reaches you.

This combination of visible controls and invisible defenses is what makes the Maya Black card stand out. It’s not just about reacting to fraud—it’s about preventing it.

I’ve always believed that the best security is the kind you don’t notice until you need it. For readers, this means peace of mind without the paranoia.

Trust as a Design Principle

Maya’s strategy is built on a simple but powerful idea: trust can be designed. In the Philippines, only about 15% of adults had a credit card as of 2024. That’s shockingly low compared to global averages. And one of the biggest barriers? Fear of fraud.

By giving users direct control—freeze, unfreeze, manage limits—Maya is addressing that fear head-on. It’s not just about technology. It’s about psychology. When people feel in control, they’re more likely to participate.

For readers, this means more confidence to use credit daily. Whether you’re shopping online, booking travel, or just paying bills, you can do it without the nagging worry of fraud.

A New Standard for Philippine Banking

Let’s be honest. Most banks in the country still rely on hotline-driven processes. Lose your card? Call a number. Suspicious charge? Call a number. Want to block your card? You guessed it—call a number.

Maya is breaking that mold. By making security a visible, user-facing feature, they’re setting a new standard. And once customers experience this level of control, it’s going to be hard for other banks to keep up.

I’ve covered enough fintech launches to know when something is just marketing fluff. This isn’t. This is a genuine shift in how security is delivered. For readers, this means you’re not just getting a card—you’re getting a new way of banking.

The Bigger Picture: Elevated Finance

Maya calls this part of its vision of “elevated finance.” The idea is simple: every product—whether payments, savings, or credit—should combine protection with simplicity.

That’s a refreshing take. Too often, security is treated as an afterthought, hidden in the fine print. Maya is putting it front and center.

For readers, this means you don’t have to choose between convenience and safety. You get both. And that’s how it should be.

My Take: Why This Matters

I’ve seen the evolution of digital banking in the Philippines. From the early days of clunky apps to today’s sleek, AI-driven platforms. But security has always been the elephant in the room. People want to trust digital finance, but they’re afraid.

The Maya Black credit card changes that. By making security visible, dynamic, and user-controlled, it removes one of the biggest barriers to adoption.

For readers, the benefit is clear: you get a card that doesn’t just let you spend—it lets you spend with confidence. And in a world where trust is currency, that’s priceless.

And let’s be honest—if your card can outsmart fraudsters before they even try, that’s a win worth swiping for.