Xiaomi’s Billion-RMB Blitz: Growth, Grit, Gadgets, Glory

Xiaomi’s Billion-RMB Blitz: Growth, Grit, Gadgets, Glory

Smartphones Stay Hot Despite Global Chill

Let’s start with the obvious: Xiaomi’s smartphone business is still punching above its weight. In Q2 2025, revenue hit RMB45.5 billion, with 42.4 million units shipped globally. That’s eight straight quarters of growth, and twenty consecutive quarters in the global top three. If consistency were a sport, Xiaomi would be MVP. Xiaomi’s Billion-RMB Blitz: Growth, Grit, Gadgets, Glory

But it’s not just about volume anymore. Xiaomi’s premiumization strategy is finally paying off. In Mainland China, smartphones priced above RMB3,000 now make up 27.6% of total sales—up 5.5 percentage points year-over-year. The RMB4,000–5,000 segment? Xiaomi owns 24.7% of it. The RMB5,000–6,000 bracket? A solid 15.4%. That’s not just climbing the ladder—it’s building a new one.

And while the global smartphone market continues to resemble a slow-moving traffic jam, Xiaomi’s lane is clear. The company’s ability to grow in both volume and value is a rare feat. It’s like upgrading from a tricycle to a Tesla without losing speed.

EVs Hit the Fast Lane—Finally

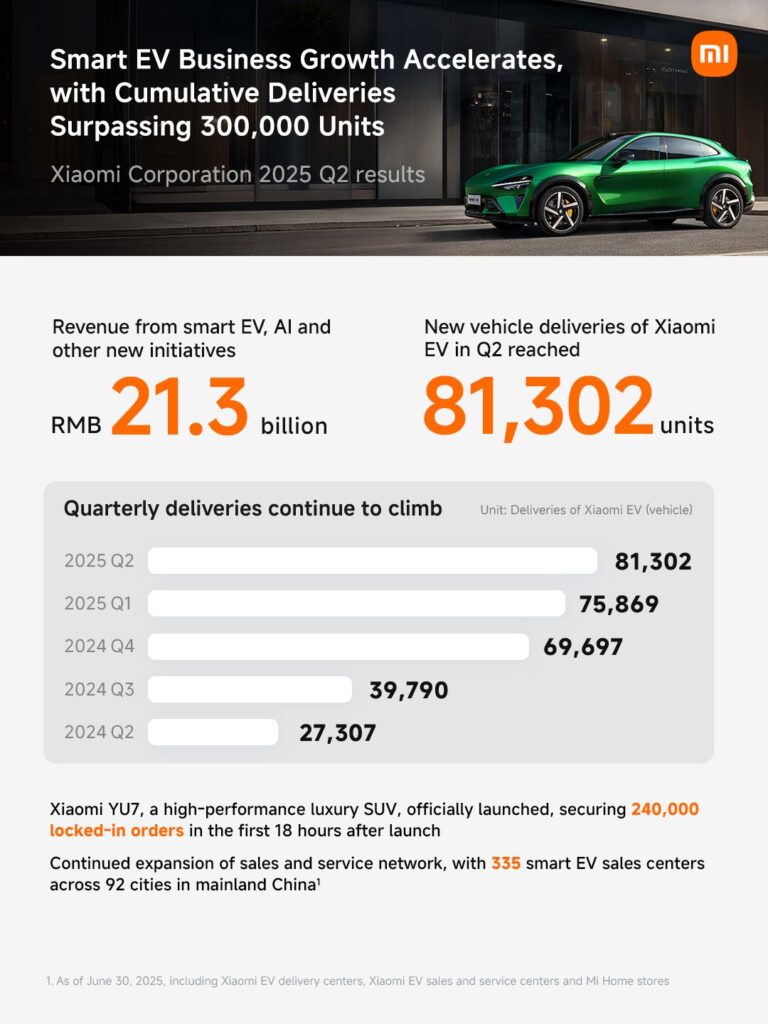

Xiaomi’s smart EV business is no longer just a flashy side hustle. It’s a full-blown growth engine. In Q2 2025, EV revenue crossed RMB20 billion for the first time, contributing to a total of RMB21.3 billion from the segment that includes AI and other new initiatives.

Deliveries? A record-breaking 81,302 units in Q2 alone. That brings cumulative EV deliveries to over 300,000 since launch. And this is before the Xiaomi YU7 SUV even hits the streets. With 240,000 locked-in orders in just 18 hours, the YU7 is shaping up to be the Beyoncé of SUVs—everyone wants one, and it’s always sold out.

Operating losses narrowed to RMB300 million, and breakeven is expected in the second half of the year. That’s not just optimism—it’s math. Xiaomi has also opened 335 smart EV sales centers across 92 cities in China. If you’re looking for scale, this is it.

IoT and Home Appliances: The Quiet Powerhouses

While smartphones and EVs grab headlines, Xiaomi’s IoT and lifestyle products are quietly rewriting the rules. Q2 revenue hit RMB38.7 billion, up 44.7% year-over-year. Gross margin rose to 22.5%, proving that smart appliances aren’t just smart—they’re profitable.

Air conditioners? Over 5.4 million units shipped, up 60%. Refrigerators? 790,000 units, up 25%. Washing machines? 600,000 units, up 45%. These aren’t just numbers—they’re refrigerators flying off shelves like concert tickets.

Xiaomi’s tablet business also flexed its muscles, with global shipments growing 42.3% year-over-year—the fastest among the top five vendors. TWS earbuds ranked No. 2 globally and No. 1 in China. And the new Xiaomi AI Glasses? Sold out. The electrochromic version is so popular, Xiaomi had to hit the production accelerator.

The AIoT platform now hosts 989.1 million connected devices (excluding phones, tablets, and laptops). Users with five or more connected devices? 20.5 million. Mi Home App MAU? 113.1 million. AI Assistant MAU? 153.2 million. That’s not just an ecosystem—it’s a digital metropolis.

Internet Services: Steady, Sticky, and Profitable

Xiaomi’s internet services business may not be flashy, but it’s quietly raking in RMB9.1 billion in Q2, up 10.1% year-over-year. The gross profit margin? A jaw-dropping 75.4%. That’s higher than most luxury brands, and Xiaomi’s not even selling handbags.

Global MAU reached 731.2 million, up 8.2%. Mainland China MAU hit 184.8 million, up 12.4%. These aren’t just users—they’re loyalists. Xiaomi’s ability to maintain high margins while expanding its user base is a masterclass in digital economics.

R&D: Chips, AI, and the Future of Everything

Xiaomi’s R&D spending hit a record RMB7.8 billion in Q2, up 41.2% year-over-year. The company now employs 22,641 R&D personnel. That’s not a team—it’s a tech army.

The big headline? Xiaomi unveiled its self-developed 3nm flagship chip, the XRING O1. That makes Xiaomi the fourth company globally—and the first in Mainland China—to pull off this engineering feat. The chip powers the Xiaomi 15S Pro and the new Pad 7 Ultra and Pad 7S Pro. All launched in Q2. All well-received.

In AI, Xiaomi released and open-sourced its multimodal large language model, MiMo-VL-7B. Twelve papers were accepted by ICCV and ACL 2025. Then came MiDashengLM-7B, an audio reasoning model that topped 22 benchmarks. Xiaomi isn’t just playing catch-up—it’s setting the pace.

Xiaomi’s Not Just Growing—It’s Evolving

Three straight quarters above RMB100 billion in revenue. A 75.4% surge in adjusted net profit. A diversified portfolio that includes smartphones, EVs, smart homes, internet services, and core tech. Xiaomi isn’t just surviving—it’s thriving.

And if you’re wondering whether this is sustainable, consider this: Xiaomi is scaling premium segments, expanding globally, and investing heavily in R&D. It’s not just building products—it’s building platforms. The kind that turn users into ecosystems, and ecosystems into empires.

In short, Xiaomi’s Q2 2025 results aren’t just impressive—they’re a blueprint for how to grow smart, scale fast, and stay relevant. Even in a market that’s constantly shifting gears.