Philippines Charges Ahead: NEV Growth and Market Leaders

Philippines Charges Ahead: NEV Growth and Market Leaders

A Nation on the Move

In 2024, the Philippines Charges Ahead: NEV Growth in sustainable mobility. The adoption of New Energy Vehicles (NEVs)—including battery-electric vehicles (BEVs), plug-in hybrids, and fuel cell electric vehicles—accelerated at a pace few anticipated. Driven by rising fuel costs, environmental awareness, and government incentives, Filipinos began to embrace electric mobility not just as a trend, but as a lifestyle.

The numbers speak volumes. The NEV market in the Philippines reached a valuation of USD 1.14 billion in 2024 and is projected to grow to USD 4.7 billion by 2029. That’s a compound annual growth rate of 32.73%. But one brand didn’t just ride the wave—it created it.

BYD: The Unmatched Leader in NEV Sales

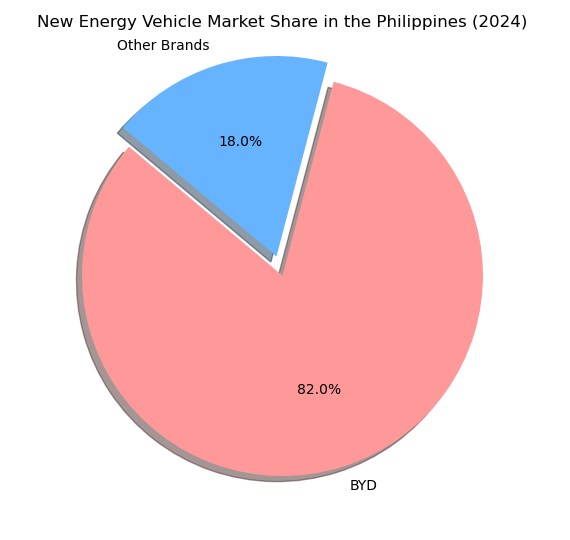

BYD Cars Philippines, in partnership with Ayala’s ACMobility, posted a jaw-dropping 8,900% growth in NEV sales in 2024 compared to the previous year . That’s not a typo. It’s a market-defining moment. With 4,780 units sold, BYD captured 82% of the Philippine NEV market. In the BEV segment alone, the brand held a 69% share. The Sealion 6 DM-i hybrid SUV emerged as the top-selling model, moving 2,669 units and securing a 19% share of the combined NEV and HEV segments

BYD’s strategy was aggressive and effective. It expanded its dealership network from just two locations at the start of 2024 to 25 by year-end. That expansion enabled broader reach and deeper market penetration.

The company also introduced a diverse lineup of models tailored to Filipino consumers—from the compact Seagull to the sporty Atto 3 and the luxurious Han EV. Each vehicle combined smart features, competitive pricing, and impressive range.

Pie Chart: NEV Market Share in the Philippines (2024)

Here’s a visual snapshot of the market:

BYD’s dominance is clear. The remaining 18% is shared among other brands—some local, some international, all trying to catch up.

Other Players in the Race

While BYD leads, other brands are making strategic moves. Nissan, Hyundai, and Chery have introduced electric and hybrid models to the Philippine market. Nissan’s Leaf and Hyundai’s Ioniq series have gained traction among eco-conscious consumers.

Chery, with its Tiggo hybrid lineup, is also carving out a niche. But none have matched BYD’s scale, speed, or strategy.

Local startups and importers are entering the fray too, offering affordable electric scooters, compact EVs, and conversion kits. The ecosystem is growing, and competition is heating up.

Government Support: Policy Meets Progress

The Philippine government has played a crucial role in accelerating NEV adoption. Through the Electric Vehicle Industry Development Act (EVIDA), incentives for manufacturers, importers, and consumers have been rolled out.

Tax breaks, reduced import duties, and registration perks are making NEVs more accessible. LGUs are also investing in charging infrastructure, with Metro Manila leading the way.

Public transport is getting a green makeover too. E-jeepneys and e-buses are being deployed in pilot programs across major cities. The goal? A cleaner, quieter, and more efficient urban mobility system.

Consumer Behavior: From Curiosity to Commitment

Filipino consumers are warming up to NEVs. Rising fuel costs, environmental awareness, and the appeal of cutting-edge tech are driving interest.

BYD’s models, especially the Atto 3 and Seagull, have resonated with younger buyers. These vehicles offer sleek design, smart features, and impressive range—all at competitive prices.

The shift isn’t just about cars. It’s about lifestyle. NEV owners are embracing apps, smart charging, and energy-efficient driving habits. The culture is evolving.

Challenges Ahead: Infrastructure and Education

Despite the momentum, challenges remain. Charging infrastructure is still limited outside urban centers. Range anxiety persists, especially for long-distance travel.

Education is another hurdle. Many consumers are unfamiliar with NEV maintenance, battery life, and charging protocols. Dealerships and manufacturers must invest in awareness campaigns and after-sales support.

Financing options also need to evolve. Banks and lenders must tailor products for NEV buyers, considering battery warranties and resale values.

The Road Ahead: What’s Next?

2025 promises to be even bigger. BYD plans to introduce more models, including the Dolphin and Han EVs. Other brands are expected to ramp up their offerings, and the government is pushing for more public-private partnerships.

Charging stations will expand, especially in malls, gas stations, and residential areas. Fleet operators are exploring NEVs for logistics and delivery services.

The Philippines is on the cusp of an electric revolution. And it’s not just about vehicles—it’s about vision.

Final Thoughts: A Nation in Motion

The adoption of New Energy Vehicles in the Philippines is more than a market trend. It’s a movement. Led by BYD and supported by policy, infrastructure, and consumer demand, the country is accelerating toward a smarter, greener future.