Maya Launches FINFIT Program to Strengthen School Finances

Maya Launches FINFIT Program to Strengthen School Finances

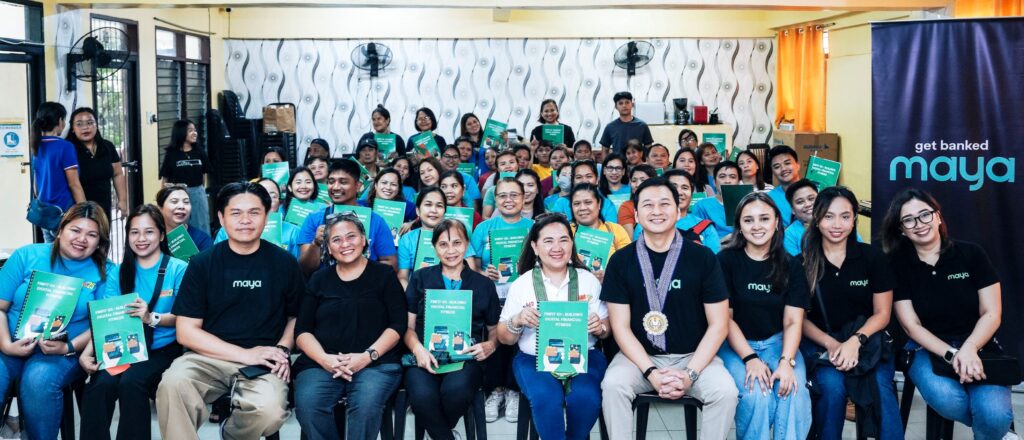

Rolling Out Financial Fitness During Brigada Eskwela

Maya’s Financial Fitness (FINFIT) Program made its debut in Mandaluyong City just in time for this year’s Brigada Eskwela. Two public schools—Ilaya Barangka Integrated School and Highway Hills Integrated School—opened their doors for a pilot run. Maya teamed up with the Department of Education (DepEd) to engage teachers, non-teaching staff, parents, and students in hands-on workshops that bring real-world money skills into the classroom.

Fintech leader Maya believes financial health goes beyond theory. It’s about giving people control over their resources and their future. That mission came alive under sun-lit classrooms, where educators learned alongside parents about digital savings and scam prevention. The result was a community-wide conversation about money that didn’t slow down after the school bell rang.

Hands-On Learning for Teachers and Parents

Workshops paired quick, interactive exercises with modern fintech tools. Participants opened demo digital wallets. They set saving goals. They practiced vetting suspicious text messages. Some sessions focused on responsible credit use—teaching attendees to read loan offers and calculate interest. Others zeroed in on building budgeting habits, from splitting grocery bills fairly to tracking daily expenses.

Teachers found new ways to fold financial topics into history, math, or even language classes. Parents saw how digital wallets can simplify allowances and emergency funds. Non-teaching staff—those often overlooked—left confident they could handle their own household finances better.

One principal noted how a simple budgeting game sparked laughter and rich discussion. “I’ve never seen staff so eager to talk about money,” she said. That excitement is exactly what Maya wants.

Cultivating Lifelong Financial Habits

The FINFIT curriculum isn’t a one-off seminar. It’s built around habit formation. Sessions introduced daily check-ins—asking families to log a small expense each evening, discuss it over dinner, and then reflect on how it fits into a weekly plan.

On-site coaches modeled proactive behaviors. They set up automatic savings transfers. They showed how to freeze digital wallets to prevent fraud. They taught a budgeting mantra: “Track. Reflect. Adjust.”

Small steps, repeated often. That’s how a lesson becomes second nature. Maya’s goal is that by the time these students head to college or enter the workforce, they’ll reach for an app, not an ATM loan, when cash runs low.

Schools as Community Financial Hubs

Schools aren’t just learning centers. They’re community anchors, shaping decisions that ripple through entire households. That’s why Maya chose Mandaluyong’s integrated schools for its pilot.

The program turned campuses into financial wellness hubs. Bulletin boards featured tips on spotting phishing scams. PA announcements reminded everyone that saving even ₱20 a week adds up. Cafeterias printed QR codes for demo wallet top-ups, letting staff and parents practice in a real-world setting.

By weaving FINFIT into the daily rhythm of school life, Maya ensures financial discussions aren’t confined to a single afternoon. Instead, the topic stays alive in hallways, break rooms, and dinner tables.

Boosting Confidence Through Technology

“Tech can feel intimidating,” Maya’s Head of Corporate Affairs, Toff Rada, explained. “Our aim was to demystify digital wallets and build confidence.”

That meant starting with the basics: downloading the Maya app, verifying identity, setting a simple PIN. Then Maya’s facilitators guided participants through advanced features—group savings pots, spend controls, and real-time transaction alerts.

By the end of the day, teachers who hadn’t logged into an e-wallet before were topping up balances, splitting payments with colleagues, and sending digital gifts to students. Confidence soared.

Expanding Toward Nationwide Resilience

Mandaluyong is just the beginning. Maya’s FINFIT Program aligns with DepEd’s vision of financially resilient learning communities. Plans are already in motion to roll out across Metro Manila, then into Luzon, Visayas, and Mindanao.

Each leg of the rollout will adapt to local needs. In farming towns, sessions will include agricultural micro-savings. In urban districts, workshops might highlight ride-hailing expenses and freelancing income management.

Maya’s partnership with DepEd also opens doors to national teacher seminars. Through virtual classrooms, thousands more educators and parents can gain FINFIT certification, ensuring consistent quality as the program scales.

Measuring Impact and Looking Ahead

Success isn’t just attendance numbers. Maya is tracking metrics like the number of demo wallets converted to live accounts, the frequency of family budget check-ins, and the reduction of on-campus loan requests. These data points will shape future iterations—adding modules on micro-investing or insurance as needs emerge.

For Maya, every piloted school is a living lab. Feedback loops with school communities will fine-tune content and delivery. The goal is simple: to embed financial empowerment so deeply that it becomes as routine as math drills or spelling bees.

Creating a More Empowered Generation

By arming educators, staff, and families with practical money skills, Maya’s FINFIT Program aims to transform entire communities. When students see parents practicing good saving habits, they internalize those behaviors. When teachers integrate budgeting examples into lessons, students absorb real-world applications.

In the long run, this pilot in Mandaluyong City could spark a nationwide shift—a generation growing up with digital financial confidence. Everyday decisions—paying bills, planning for emergencies, or saving for college—become less daunting.

Financial health, as Maya puts it, is more than knowledge. It’s control. And through the FINFIT Program, that control starts in the hallways of public schools, rippling outward to shape a more stable future for Filipino families.

To learn more about Maya, check out maya.ph and mayabank.ph