Xiaomi Q1 2025: Record Revenue, Premium Growth, Innovation

Xiaomi Q1 2025: Record Revenue, Premium Growth, Innovation

Outstanding Financial Performance

Xiaomi has just delivered one of its strongest quarters ever. In Q1 2025, the Group reported unaudited consolidated revenue of RMB111.3 billion—a 47.4% year-over-year increase that beats market expectations. This milestone is especially notable because it marks the second consecutive quarter in which Xiaomi has surpassed the RMB100 billion revenue mark. Even more impressive is the adjusted net profit, which soared by 64.5% YoY to reach a record RMB10.7 billion. Such numbers signal not only solid execution but also the strength of Xiaomi’s strategic direction as it moves deeper into 2025.

Robust Growth Across All Business Segments

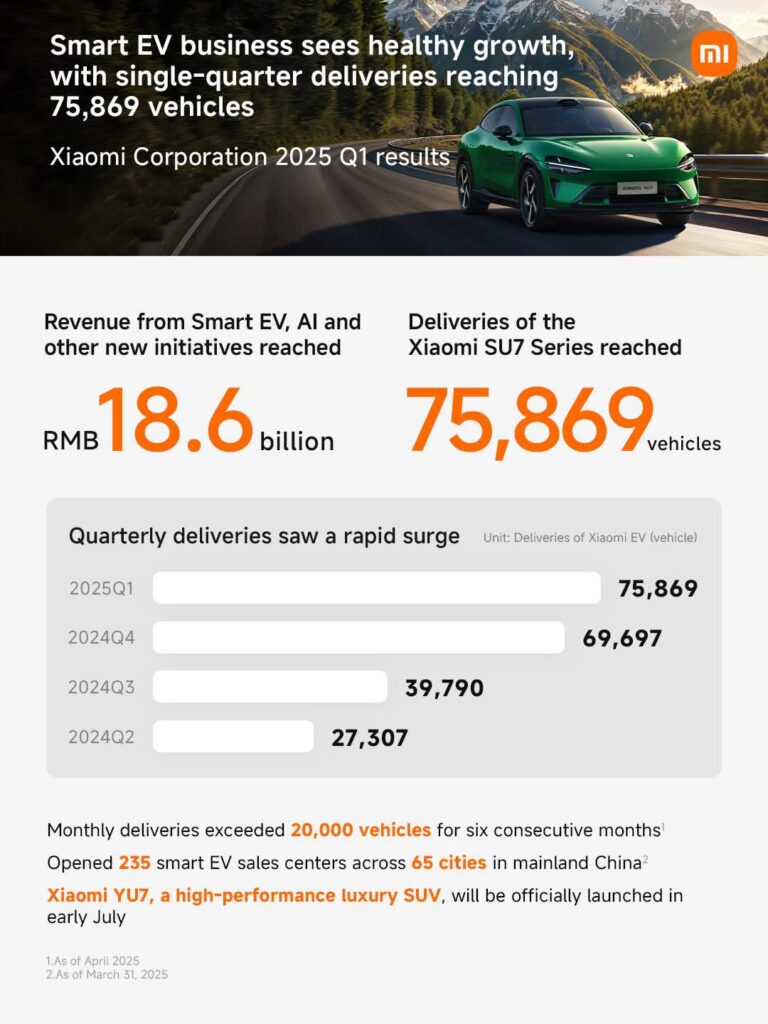

The growth Xiaomi experienced wasn’t confined to a single segment; it spread across its entire business portfolio. For instance, its smartphone division advanced by 8.9% YoY to achieve RMB50.6 billion in revenue. Meanwhile, Xiaomi’s IoT and lifestyle products segment surged an astonishing 58.7% YoY, reaching RMB32.3 billion. This impressive jump was bolstered by record shipments of home appliances like washing machines and refrigerators, while even air-conditioner sales defied market headwinds, growing over 65% YoY. Adding to this diversified growth, revenue from the smart Electric Vehicle (EV), AI, and other new initiatives climbed to RMB18.6 billion, with deliveries of the Xiaomi SU7 Series vehicles totaling 75,869 units in the quarter.

Premiumization Driving Success

Central to Xiaomi’s performance this quarter is its premiumization strategy. Xiaomi has been shifting its focus toward higher-margin products, and the results speak for themselves. The average selling price (ASP) of Xiaomi smartphones in Q1 2025 reached a record high of RMB1,211. Notably, the Xiaomi 15 Ultra, which was launched back in February, saw its sales grow by an impressive 90% compared to its predecessor in the same period. This move towards premium products is not just changing the numbers; it’s transforming the brand’s market positioning and consumer perception, especially in high-end segments.

Dominance in the Smartphone Market

Xiaomi continues to solidify its presence in the fiercely competitive smartphone market. In Q1 2025, global smartphone shipments reached 41.8 million units, marking seven consecutive quarters of YoY growth in global shipments, and Xiaomi maintained a place in the global top three for the nineteenth consecutive quarter with a 14.1% market share. In mainland China, Xiaomi’s performance has been particularly noteworthy; its market share jumped by 4.7 percentage points YoY to hit 18.8%. This is Xiaomi reclaiming the top spot in shipments—a position it hasn’t held in mainland China for a decade. The rise in market share is driven by the growing popularity of Xiaomi’s premium smartphones, with units sold in the RMB3,000 and above segment increasing by 3.3 percentage points and those above RMB4,000 by 2.9 percentage points YoY.

IoT and Lifestyle Products: A New Growth Frontier

Xiaomi’s IoT and lifestyle products segment is on fire. Revenue here soared by 58.7% YoY to RMB32.3 billion, and the gross margin for this segment improved by 5.4 percentage points to 25.2%. This segment recorded new highs not only in revenue but also in the performance of key products. Despite the typical off-season for home appliance sales, Xiaomi’s smart large home appliances—the likes of air conditioners, refrigerators, and washing machines—have seen explosive growth. Air conditioner shipments topped 1.1 million units, refrigerators surpassed 880,000 units, and washing machine shipments more than doubled to reach 740,000 units. Xiaomi’s new smart home appliance factory, set to commence operations later this year, is expected to further boost these impressive figures.

Tablets, Wearables, and the Expanding AIoT Ecosystem

There’s more to Xiaomi than just smartphones and home appliances. Its tablet business remains robust, with global shipments growing by 56.1% YoY, which has propelled Xiaomi into the top three globally for the first time and kept it firmly in the No. 3 spot in mainland China. In the wearables category, Xiaomi’s shipments continue to lead the pack globally in certain product lines—its wearable bands rank No. 1 worldwide and No. 2 in mainland China. Similarly, its TWS earbuds claim the No. 2 position globally and No. 1 in the local market.

The overall AIoT ecosystem is expanding rapidly. By the end of March 2025, the number of connected IoT devices on Xiaomi’s platform (excluding smartphones, tablets, and laptops) shot up to 943.7 million—up 20.1% YoY. Meanwhile, users with five or more connected devices reached 19.3 million, an increase of 26.5% YoY. Xiaomi’s Mi Home App grew to 106.4 million monthly active users, and its AI Assistant reached nearly 147 million MAU—figures that underscore how indispensable Xiaomi’s ecosystem has become in everyday life.

Internet Services: Scaling Profitability

Xiaomi’s internet services division is another bright spot. Revenue in this segment increased by 12.8% YoY to RMB9.1 billion, and its gross margin widened by 2.7 percentage points to an impressive 76.9%. Alongside this, the user base has hit record highs globally, with March 2025 figures showing 718.8 million global monthly active users and 181.1 million in mainland China alone—a YoY increase of 9.2% and 12.9%, respectively. These numbers reflect not just growth in monetization, but also a deeper digital engagement with Xiaomi’s ecosystem.

Electric Vehicles and New Initiatives: Charging into the Future

Xiaomi’s strategic move into smart EVs, AI, and other new initiatives is another driver of the Group’s robust performance. In Q1 2025, revenue from these emerging sectors hit RMB18.6 billion. Deliveries of the Xiaomi SU7 Series vehicles reached 75,869 units, and Xiaomi is ramping up production with a full-year delivery target of 350,000 vehicles. The expansion of its smart EV sales network, which now spans 235 centers in 65 Chinese cities, highlights Xiaomi’s determination to carve out a significant foothold in the EV market.

Xiaomi’s premium EV offerings are also gaining traction. The Xiaomi SU7 Ultra, launched in February, has redefined the premium segment with vehicles starting above RMB500,000. With cumulative EV deliveries exceeding 258,000 units and monthly figures consistently above 20,000 for six consecutive months, Xiaomi is fast becoming a major player in the automotive industry.

R&D and Future Technology Investments

Xiaomi Q1 2025: Record Profits and One of Xiaomi’s most visionary moves is its commitment to research and development. In Q1 2025, R&D expenses reached RMB6.7 billion—a 30.1% YoY increase—as Xiaomi pushed its R&D personnel count to a record 21,731. The Group has been proactive in extending its intellectual property portfolio, now boasting over 43,000 patents worldwide. Looking ahead, Xiaomi plans to invest a staggering RMB200 billion in R&D over the next five years. This massive investment is aimed at building a long-term technology moat around its core competencies in chip, AI, and operating system innovations.

A major milestone in this commitment came on May 22 when Xiaomi unveiled its self-developed Xiaomi XRING O1 3nm SoC, already being rolled out in smartphones and tablets. This breakthrough represents the full deployment of Xiaomi’s core foundational technologies—“Chip, AI and OS”—and sets a new global benchmark for innovation, reinforcing the company’s technology ecosystem.

Premiumization Strategy: Raising the Bar on Quality

Across all business segments, Xiaomi’s premiumization strategy has paid off handsomely. In the smartphone division, for example, the average selling price increased to a record RMB1,211. Consumers are gravitating towards higher-end products, as evidenced by the strong performance of models like the Xiaomi 15 Ultra, which saw a 90% sales growth compared to its predecessor. This trend is not isolated; even in the home appliance and EV segments, premium offerings are capturing greater market share and driving overall revenue growth.

Market Share and Global Expansion

Xiaomi’s global smartphone shipments reached 41.8 million units in Q1 2025, marking seven consecutive quarters of YoY growth. On the global stage, Xiaomi has maintained a top-three ranking for the nineteenth consecutive quarter with a 14.1% market share. In mainland China, the company’s smartphone market share soared by 4.7 percentage points YoY to 18.8%, reclaiming its position as the number one smartphone brand in shipments after a decade away from the top spot. Such achievements prove that Xiaomi’s relentless drive for quality and innovation is resonating with consumers both domestically and internationally.

The Future Looks Bright for Xiaomi

From premium smartphones to cutting-edge smart appliances, from a rapidly expanding IoT ecosystem to a bold entry into EVs, Xiaomi’s Q1 2025 performance reveals a company that is evolving on multiple fronts. The robust growth across all business segments isn’t just a success in numbers—it’s a definitive signal that Xiaomi’s strategy of premiumization and innovation is set to redefine the industry landscape.